🌏 From Chennai to Silicon Valley — The Unlikely Journey of Zoho

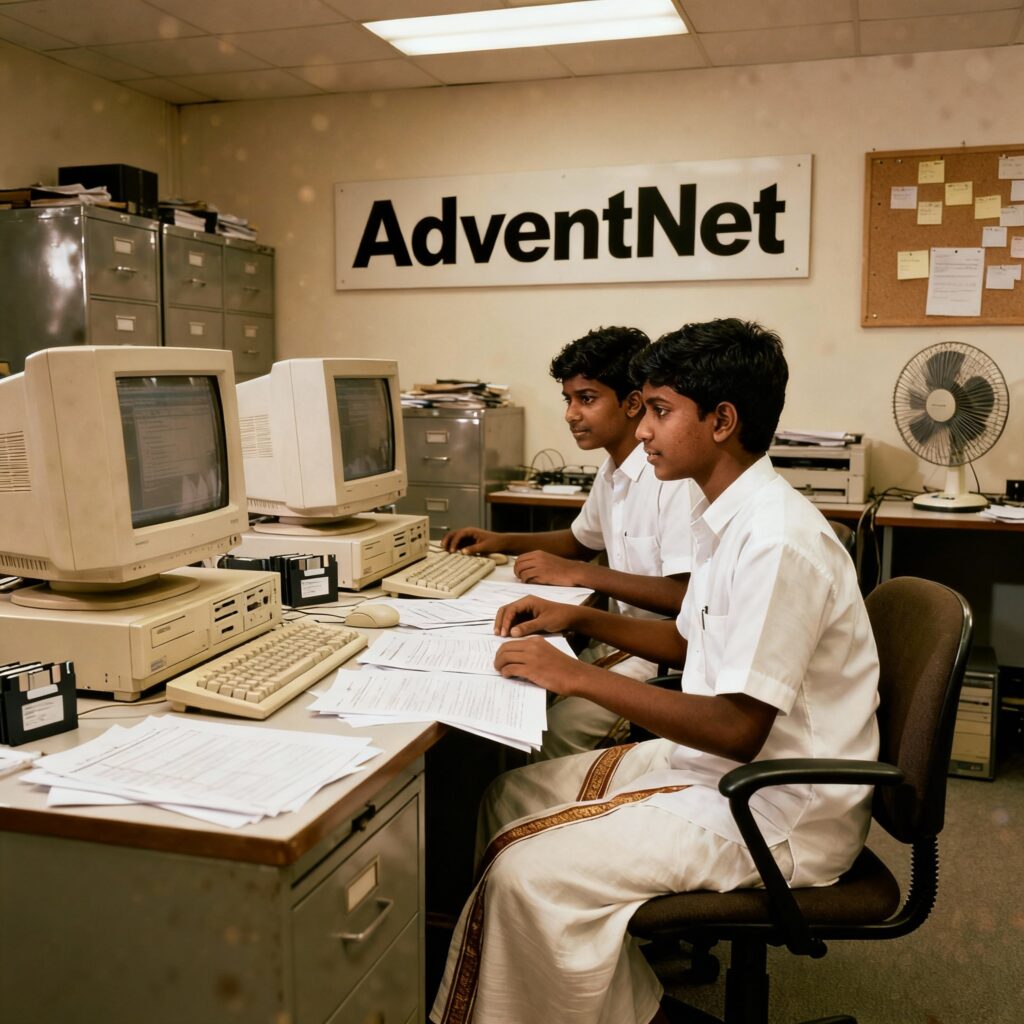

In the mid-1990s, when the world was waking up to the internet, Sridhar Vembu and Tony Thomas started a modest venture in a small apartment in Chennai. Back then, India didn’t even have strong broadband connectivity, and the startup ecosystem was nearly non-existent.

They named their company AdventNet in 1996. It served telecom equipment makers in Japan and the U.S. The company’s engineers in Chennai would code all night to match American working hours — there were no video calls, just faxes and emails. Slowly, AdventNet’s affordable and reliable software started attracting U.S. telecom clients.

At the time, Sridhar Vembu was living in the United States and working comfortably in Silicon Valley. Sales were collapsing, and AdventNet needed a miracle—or at least a salesman. His brothers’ call for help changed everything. Sridhar, never one to shy away from a challenge, printed new business cards titled “VP of Marketing & Business Development” and began knocking on doors. He landed big American clients, though often at bafflingly low margins. As one client jokingly told him later, “We’d have paid you ten times more.” But Sridhar didn’t care.

By 1998, AdventNet crossed its first real milestone—$1 million in revenue. Finally, the team could pay themselves modest salaries and hire their first dedicated sales members. The following year, they soared to $10 million in revenue, Sridhar assumed the role of CEO, and the company even turned down a $10 million venture capital offer that valued them at $140 million. It was an act of defiance that would come to define the company’s DNA—faith in customers, not investors

✈️ The U.S. Leap

In 1999, as their client base in the U.S. grew, Sridhar Vembu decided to move there — not to raise capital, but to be closer to customers. He set up a small office in Pleasanton, California, which became Zoho’s U.S. headquarters. The Chennai team continued to be the product development backbone—a key principle of the Zoho business model even today

Then came the dot-com crash of 2000. Tech companies fell, taking with them vendors and clients who owed AdventNet money. Thousands went bankrupt. The entire industry trembled—but AdventNet survived. The reasons were simple yet profound: they had money in the bank, no investors to appease, and operations rooted in India, where costs were inherently low. In survival, they found strength. By 2002, they emerged stronger with a new venture, ManageEngine—an IT management tool that carved its own success.

Vembu realized something profound:

“Every small business in the world will someday need enterprise-grade software — affordable, integrated, and easy to use.”

💡 The Turning Point — From AdventNet to Zoho

In 2005, AdventNet launched a new division dedicated to cloud applications. That division eventually adopted a name the world would come to know—Zoho. From CRM to word processors, email to spreadsheets, Zoho’s tools grew rapidly. By 2008, they had over a million users.

So AdventNet shifted focus from network tools to business productivity and enterprise software. In 2009, it rebranded to Zoho Corporation, named after its first major product line: Zoho Office Suite (Word processor, Sheet, Show, Mail).

But as Zoho scaled, a new challenge loomed: scarcity of skilled engineers in India. The top talent was being swallowed by multinationals and startups burning investor money. For a bootstrapper like Sridhar, this meant potential stagnation. His solution was audacious yet refreshingly humane—build talent instead of buying it. In 2004, before “skill development” became a buzzword, Zoho launched Zoho University (now Zoho Schools of Learning). It offered free, two-year education in programming, English, and mathematics for students straight out of high school, often from rural families. They received stipends. Graduates were offered jobs at Zoho.

One story stands out: Abdul Alim, who once worked as a security guard, enrolled at Zoho University and became a software engineer. His journey mirrors thousands of others who found both livelihood and dignity through Sridhar’s vision of democratizing opportunity.

By the 2020s, Zoho had become a billion-dollar powerhouse with over 55 products, including Zoho Mail, Zoho CRM, and Zoho WorkDrive. Yet, instead of settling into corporate luxury, Sridhar made another radical move—he shifted his base to a remote village 300 miles from any major city. To him, it wasn’t a retreat but a revolution. He believed that the next frontier of innovation was not in skyscraper offices but in rural landscapes filled with untapped potential

🌍 “Made in Rural India, Sold Globally”

In later years, Vembu’s journey came full circle. He moved back to Tenkasi, a rural part of Tamil Nadu, where Zoho opened a rural campus. Today, a large part of Zoho’s coding and innovation happens there — proof that world-class products can emerge from India’s villages, not just metros.

From a small apartment in Chennai to a sustainable SaaS empire serving 100+ countries, Zoho business model is not just about software — it’s about self-reliance, belief, and long-term vision.

💡 What Problem Does Zoho Solve?

Zoho targets a universal business problem — fragmented enterprise software. Businesses often juggle dozens of disconnected apps, causing data silos and inefficiency. Companies struggle with multiple tools that don’t talk to each other — CRMs, project tools, HR apps, analytics, and billing systems.

Zoho solves this by integrating everything into one coherent platform — Zoho One — saving time, money, and complexity for Small and Medium Businesses (SMBs) and enterprises alike. Zoho One forms the core of Zoho business model.

Zoho One solves this chaos with a unified ecosystem of 55+ integrated apps—covering CRM, finance, HR, operations, and marketing—so every team works in sync, sharing one database, one login, and one seamless digital workspace.

| Category / Suite | Function | Zoho Product |

|---|---|---|

| 1️⃣ ERP Suite | Accounting & Finance | Zoho Books |

| Stock & Order Management | Zoho Inventory | |

| HR & Payroll | Zoho People | |

| Project Management | Zoho Projects | |

| 2️⃣ CRM Suite | Core CRM | Zoho CRM |

| Live Chat & Visitor Tracking | Zoho SalesIQ | |

| Email Marketing | Zoho Campaigns | |

| Customer Support / Helpdesk | Zoho Desk | |

| 3️⃣ Collaboration Tools | Team Chat | Zoho Cliq |

| Video Conferencing | Zoho Meeting | |

| Cloud Storage & File Sharing | Zoho WorkDrive | |

| Task Collaboration | Zoho Projects | |

| 4️⃣ Productivity Suite | Word Processor | Zoho Writer |

| Spreadsheet | Zoho Sheet | |

| Presentation Tool | Zoho Show | |

| Business Email | Zoho Mail | |

| 5️⃣ Specialized Tools | Low-code App Builder | Zoho Creator |

| BI & Reporting | Zoho Analytics | |

| Workflow Automation | Zoho Flow | |

| Password Management | Zoho Vault | |

| Digital Signature | Zoho Sign |

💰 Zoho Business Model

🎯 Segmentation, Targeting & Positioning (STP)

- Segmentation: Small and mid-sized enterprises seeking affordable, integrated business software.

- Targeting: Cost-conscious businesses in India, the US, and emerging markets.

- Positioning: “A powerful suite that works like a big company system, but priced for small businesses.”

Revenue Model: Subscription-based SaaS

- Zoho One: Bundled suite with per-employee pricing

- Freemium offerings: Mail, Writer, and Creator attract new users

- Individual app subscriptions: ERP, CRM, Collaboration tools, Productivity tools, Specialized tools

Revenue (FY 2024): $1.37 billion

Regional Breakdown:

- North America: ~45%

- India: ~20%

- Europe: ~15%

- Others: ~20%

📈 Profitability

- Net Profit Margin: ~28% (FY 2024)

- Cash Flow: Positive Cash Flow, low debt, reinvested profits

- No external investors = No dilution of ownership

🌍 Market Share

India’s enterprise software market is currently valued at $11.52 billion (2024) and is expanding rapidly at around 14–15% CAGR, driven by digital transformation, SaaS adoption, and the formalization of the SMB economy.

Within this $11.52 billion, four key sub-segments dominate — and Zoho plays meaningfully in all of them:

| Segment | Market Size (2024) | Typical Users | Example Players | Zoho Offerings |

|---|---|---|---|---|

| ERP | $3.21 B | Manufacturing, logistics, large SMBs | SAP, Oracle, Tally | Zoho Books, Zoho Inventory, Zoho People, Zoho Projects |

| CRM | $2.31 B | Sales-driven orgs, marketing teams | Salesforce, Freshworks | Zoho CRM, Zoho Campaigns, Zoho SalesIQ |

| Collaboration | $0.78 B | Distributed teams, remote workforce | Slack, Microsoft Teams | Zoho Cliq, Zoho WorkDrive, Zoho Meeting |

| Productivity | $0.414 B | All office users | Google Workspace, Microsoft 365 | Zoho Mail, Writer, Sheet, Show |

🚀 Zoho’s Footprint Within These Segments

While exact figures aren’t publicly disclosed, industry estimates and usage data suggest the following approximate market share for Zoho in India:

| Segment | Zoho’s Estimated Share | Interpretation |

|---|---|---|

| ERP | 5–6% | Competes in accounting, HR, and project modules — strong SMB traction but not yet enterprise-dominant. |

| CRM | 9–10% | One of the top three CRMs in India by active SMB adoption, challenging Salesforce and Freshworks. |

| Collaboration | ≈12% | Rapid growth due to Zoho Cliq and WorkDrive adoption during post-pandemic remote-work boom. |

| Productivity | 7–8% | Competes with Google Workspace & Microsoft 365 for cost-sensitive SMBs preferring Indian data localization. |

These numbers translate to an overall market share of roughly 7–9% of India’s enterprise SaaS space, making Zoho the largest homegrown enterprise software provider in the country.

🧮 Market Analysis

The size of the Indian enterprise software market is estimated at US $11,517.7 million (≈US $11.52 billion) in 2024 (Grand View Research).

It is projected to grow to about US $26,428.5 million by 2030 (≈US $26.43 billion) at a CAGR of ~14.9% for 2025–2030.

| Region | Enterprise Software Market | Parent IT Industry |

|---|---|---|

| India | ~$11.5 B | ~$250 B IT Industry |

| Global | ~$550 B | ~$5 T ICT Industry |

🧩 Industry Analysis

The Enterprise Software Market is a sub-sector within the larger Information Technology (IT) Industry — more precisely, under the Software & Services branch. Here’s how the industry hierarchy looks:

| Hierarchy Level | Description | Includes / Examples | Key Players |

|---|---|---|---|

| 1️⃣ Information & Communication Technology (ICT) Industry | The broadest parent category encompassing all technologies that enable digital communication, data processing, and automation. | – Hardware: Computers, servers, semiconductors, networking gear – Software: System, application, enterprise – IT Services: Consulting, integration, maintenance – Telecom Services – Cloud Infrastructure | Broad industry level; includes global tech companies like Intel, Cisco, IBM, Microsoft |

| 2️⃣ Information Technology (IT) Sector | A subset of ICT focused on software and computing services. | – Software: System Software + Application Software – IT Services – Cloud Computing – Data Management – Cybersecurity | Infosys, TCS, Wipro, Accenture, IBM |

| 3️⃣ Software Industry | Within IT, the software industry creates and maintains programs for business and consumer use. | – System Software: Operating systems, databases, middleware – Application Software: Tools for end-users (business or consumer) | Microsoft, Oracle, Adobe, SAP |

| 4️⃣ Enterprise Software Industry | A subcategory of Application Software focused on business and organizational use, not individual consumers. | – ERP (Enterprise Resource Planning) – CRM (Customer Relationship Management) – HRMS (Human Resource Management Systems) – Accounting – Collaboration – Productivity – BI & Analytics | Zoho, SAP, Oracle, Microsoft, Salesforce, Freshworks |

✅ What’s driving growth for Zoho business model in India

- Large untapped SMB base in India

- India has ~63 million+ homegrown small and medium businesses (SMBs). mint

- Zoho targets this SMB base with affordable, integrated SaaS tools — a perfect match for SMB needs.

- Its offering aligns with SMB pain-points: cost constraints, need for simple scalable software, cloud transition.

- SMB segment adoption & volume advantage

- The company says it serves over 600,000 businesses globally and over 90 million users.

- In India specifically, Zoho notes that the India business is among its fastest-growing geographies.

- The SMB segment gives Zoho a volume base: lower price per customer, but high total count.

- Upmarket expansion complementing SMB roots

- Although SMBs are core, Zoho also reports that its “mid-market & enterprise segment” in India is growing strongly: ~65 % CAGR over the past three years in ARR for that segment.

- That means growth from SMBs helps build the base; then Zoho upsells or moves “up-market” into larger customers.

📊 Growth Upside Possibilities from SMBs (with numbers)

Here are some estimates and what they mean for Zoho’s future growth in India:

- From the interview/data: India’s SMB base (~63 million+) is large. Zoho suggests that demand from these SMBs alone can generate more than US$1 billion revenue from India over the next few years.

- Zoho’s India revenue contribution was ~15 % of overall revenue, as per a quote.

- If Zoho India business grows >30 % year-on-year, as suggested for next five fiscals.

What this implies

- Suppose Zoho India current revenue is ~US$150–200 million (given 15% of US$1 billion global figure).

- At >30% growth, in 5 years revenue could roughly double or more (~2.4× if 30% CAGR).

- If the SMB portion alone can generate US$1 billion over next few fiscals, that’s a ~5-6× upside from current India base.

- Plus, cross-sell effect: each SMB customer that adopts one app may expand to multiple apps (e.g., CRM → Books → People → Projects) increasing Revenue per Customer (ARPC).

🌅 What’s ahead for Zoho : The unstoppable engine

As the global enterprise software market races toward $500 billion, Zoho stands out as a rare breed — a fiercely independent company that has not just survived but thrived against trillion-dollar titans.

Sridhar Vembu’s refusal to sell or go public isn’t just a business decision — it’s a statement. It protects Zoho from being swallowed by acquisition-hungry conglomerates and ensures the company continues to grow on its own terms, guided by purpose, not quarterly pressure. If Zoho stays its course — focusing on affordability, integration, and ethics-driven innovation — the next decade might not just belong to unicorns chasing valuation, but to the quiet elephant from Tenkasi building an enduring legacy.

If you’re inspired by Zoho success story, and want to take next leap of success by beating the odds, here is our pick for you-