In an India that quietly runs on cash-flow, a billion-dollar valuation story has become modern badge of success. Founders chase it. Media celebrates it. Youths dream it.

Walk into any startup event in India and you’ll hear the same words echoing across panels and pitch decks: valuation, funding rounds, unicorns.

Yet, step outside the spotlight—into industrial areas, transport hubs, wholesale markets, and service clusters—and you’ll discover a different India.

From transporters and distributors to repair services, warehouses, packaging suppliers, and small manufacturers—these businesses rarely make headlines. But they do something far more important:

They generate real money, every single day.

This is the story of why India runs on cash-flow businesses, not unicorns—and what that reveals about sustainable business models.

The Unicorn Obsession: Valuation vs Value

India is now home to 110+ unicorns, making it the world’s third-largest startup ecosystem. On paper, that’s an incredible achievement.

But here’s the less glamorous data point:

According to multiple industry reports, over 80% of Indian unicorns are still loss-making.

Many depend on:

- Continuous funding rounds

- Aggressive discounts

- High customer acquisition costs

- Deferred profitability promises

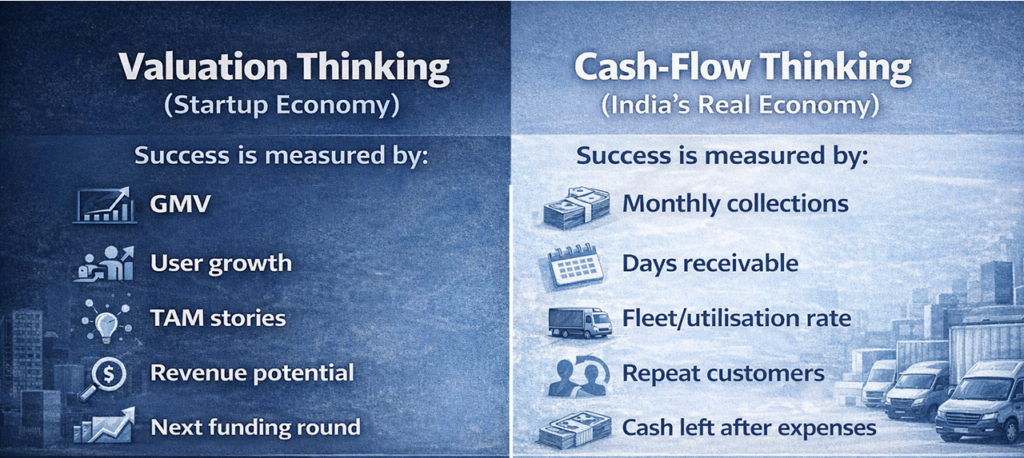

In effect, valuation becomes the goal.

A unicorn valuation does not necessarily reflect:

- Strong unit economics

- Consistent cash flow

- Or a resilient business model

It reflects investor expectations of future dominance.

And expectations, as history shows, are fragile.

Cash Flow: The Metric That Actually Pays the Bills

Unlike valuation, cash flow is brutally honest.

You either have money coming in—or you don’t.

Cash-flow businesses optimize for:

- Daily collections

- Predictable margins

- Fast inventory turnover

- Repeat customers

There are no vanity metrics here. No “GMV growth stories” without profit. No “user traction” disconnected from revenue.

If the business stops generating cash, it stops existing.

And that constraint is precisely why these businesses are resilient.

👉 Why cash-flow is crucial for continuity, growth and creditworthiness of everyday business

India’s Invisible Giants: Where Real Money Is Made

Let’s look at where India’s economic engine truly runs.

Transport & Logistics Operators

India has over 10 million trucks, most owned by small fleet operators with 1–10 vehicles.

These businesses:

- Run on advance payments or short credit cycles

- Generate predictable monthly cash flow

- Have asset-backed balance sheets

A single 10-truck operator can earn ₹3–6 lakh per month in net profit.

Distributors & Wholesalers

FMCG, pharma, electronics—India’s distribution backbone is built on thin margins and massive volume.

Key characteristics:

- Rapid inventory churn

- Low customer acquisition cost

- Strong supplier relationships

Many mid-sized distributors generate ₹1–3 crore in annual profit, entirely funded by internal cash flow.

Service Businesses That Repeat Daily

Think of:

- Equipment repair services

- Industrial maintenance

- Facility management

- Security services

These businesses thrive because:

- Demand is non-discretionary

- Contracts are recurring

- Cash inflows are predictable

No dreams here—just steady cash flow and compounding growth.

👉MSME’s contribution to GDP rises

Why Cash-Flow Businesses Scale Quietly

One reason these businesses are overlooked is that they scale differently.

Unicorns scale by:

- Burning capital

- Expanding fast

- Acquiring users ahead of profitability

Cash-flow businesses scale by:

- Reinvesting profits

- Adding capacity gradually

- Protecting margins

This makes their growth:

- Slower

- Less visible

- Far more durable

A transporter adds 2 trucks per year.

A distributor adds 5 new retailers per quarter.

A warehouse owner adds one facility every 18 months.

This is organic scaling, not blitz scaling.

The Business Model Difference: Cash First vs Growth First

At the heart of this contrast lies the business model.

Unicorn-Driven Business Model

- Customer acquisition precedes profitability

- Cash flow is delayed

- Valuation is delayed

- Valuation depends on future dominance

- High sensitivity to capital markets

Cash-Flow-Driven Business Model

- Revenue precedes expansion

- Cash flow funds growth

- Valuation (if any) is secondary

- Less dependent on investor cycles

Neither model is “right” or “wrong”.

But in a country like India—where demand is price-sensitive, infrastructure uneven, and capital cycles volatile—the cash-first model survives downturns better.

In India, predictable cash flow matters more than futuristic valuation stories. A simple example is 👉how toll booths consistently outperform car manufacturers on cash predictability.

Business Models: Read more on how instant demand creates unbeatable business models:👉 The Rise of 10-Minute Delivery & Quick Commerce

What Happens When the Funding Taps Slow?

Between 2022 and 2024:

- Startup funding in India fell by over 40%

- Multiple unicorns conducted layoffs

- Several down-rounds wiped out paper valuations

Meanwhile:

- Transporters kept moving goods

- Distributors kept supplying kirana stores

- Service businesses kept collecting monthly retainers

Cash-flow businesses didn’t need to “wait for sentiment to improve”.

They were already profitable.

The Survival Gap: VC-Backed Startups vs Cash-Driven Firms

Industry observers note that only a small fraction of VC-backed startups survive beyond five years without significant pivots, mergers, or acquisitions. Many of these startups chase growth metrics and valuations rather than building strong cash flow from early on. When funding slows or market conditions tighten, these companies struggle to survive — not because they lack potential, but because they lacked a sustainable revenue model from the start.

In contrast, traditional businesses — particularly MSMEs — demonstrate far greater longevity and stability. While MSMEs face challenges like working capital shortages and credit access issues (often reflected in weaker DSCR and liquidity ratios), their survival does not hinge on continuous funding rounds.

These businesses don’t chase unicorn status — they chase profitability and cash flow. And when the going gets tough, that currency buys resilience.

Why India Favors Cash-Flow Economics

India’s economic structure naturally rewards cash-flow businesses:

- Fragmented markets favor local operators

- High price sensitivity limits margin expansion

- Infrastructure gaps reward operational expertise

- Trust-based networks outperform digital-only models

In such an environment, execution beats innovation, and reliability beats speed.

That’s why many unicorn playbooks imported from Silicon Valley struggle to sustain themselves here.

The Future: Where Smart Capital Is Actually Moving

Interestingly, institutional capital is slowly shifting focus.

Private equity and family offices now prefer:

- Profitable SMEs

- Logistics infrastructure

- Warehousing

- Manufacturing ancillaries

Why?

Because these businesses:

- Generate steady cash flow

- Offer predictable exits

- Survive economic cycles

The unicorn era created attention. The cash-flow era creates returns.

A Better Question to Ask

Instead of asking:

“How big can this become?”

India’s smartest operators ask:

“How fast does this generate cash?”

That single question changes everything—from pricing to hiring to expansion.

Unicorns Are Loud. Cash Flow Is Powerful.

Unicorns dominate conversations.

Cash-flow businesses dominate reality.

India’s economy doesn’t collapse when startup funding slows.

It collapses if trucks stop running, warehouses stop storing, distributors stop supplying, and service businesses stop operating.

That’s the difference.

So yes, celebrate unicorns.

But if you want to understand how India actually runs, follow the cash flow, not the valuation.

Because in the end:

Valuations make headlines.

Cash flow builds nations.